Medicare drug coverage can help pay for prescription prescription drugs you will need. Even when you don’t acquire prescription prescription drugs now, you'll want to contemplate having Medicare drug protection. Medicare drug protection is optional and is offered to All people with Medicare. If you decide not to get it after you’re 1st qualified, and you don’t produce other creditable prescription drug coverage (like drug protection from an employer or union) or get More Aid, you’ll most likely pay back a late enrollment penalty in case you join a system later on. Frequently, you’ll shell out this penalty for as long as you have Medicare drug protection. To obtain Medicare drug protection, you need to sign up for a Medicare-accepted plan that provides drug protection. Each and every approach could vary in Price tag and certain prescription drugs coated.

There are actually 2 solutions to get Medicare drug coverage:

1. Medicare drug options. These plans incorporate drug protection to Original Medicare, some Medicare Expense Options, some Private Payment‑for‑Assistance plans, and Health care Price savings Account ideas. You have to have Medicare Section A (Hospital Insurance policies) and/or Medicare Section B (Healthcare Insurance policy) to affix a different Medicare drug approach.

2. Medicare Advantage Program (Element C) or other Medicare Wellbeing Approach with drug protection. You get all your Element A, Portion B, and drug protection, by way of these options. Try to remember, you needs to have Part A and Part B to hitch a Medicare Gain Approach, instead of these designs give drug protection.

Take into consideration your drug protection alternatives

Before you decide to make a choice, learn how prescription drug coverage is effective with the other drug coverage. As an example, you could have drug coverage from an employer or union, TRICARE, the Department of Veterans Affairs (VA), the Indian Health and fitness Company, or maybe a Medicare Dietary supplement Insurance policy (Medigap) policy. Look at your latest coverage to Medicare drug protection. The drug protection you already have may transform on account of Medicare drug coverage, so take into consideration all of your coverage selections.

In case you have (or are eligible for) other kinds of drug coverage, examine each of the materials you obtain out of your insurance provider or strategy service provider. Speak with your benefits administrator, insurance company, Qualified certified coverage agent,or program service provider before you make any improvements for your latest coverage.

Becoming a member of a Medicare drug system might have an impact on your Medicare Advantage Program

When you join a Medicare Benefit System, you’ll usually get drug coverage by that approach. In particular sorts of designs that may’t offer you drug protection (like Professional medical Financial click here savings Account strategies) or opt for not to provide drug protection (like certain Private Payment-for-Provider options), you can join a separate Medicare drug prepare. If you’re in a very Health and fitness Maintenance Firm, HMO Issue-of-Support prepare, or Favored Service provider Group, and also you join a separate drug strategy, you’ll be disenrolled from your Medicare

Advantage Plan and returned to Primary Medicare.

You can only sign up for a individual Medicare drug plan without losing your existing health coverage once you’re in a:

Private Charge-for-Support Program

Health-related Cost savings Account Strategy

Cost System

Specified employer-sponsored Medicare wellness plans

Check with your recent system Should you have questions about what will transpire for your present-day overall health coverage.

Another solution is to speak to an experienced,impartial, accredited Qualified insurance policies agent that may assist you.

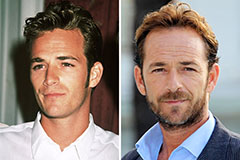

Luke Perry Then & Now!

Luke Perry Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Joshua Jackson Then & Now!

Joshua Jackson Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now! Robin McGraw Then & Now!

Robin McGraw Then & Now!